MBA at Columbia Business School Master of Financial Engineering at Columbia University

Solid Quantitative Skills

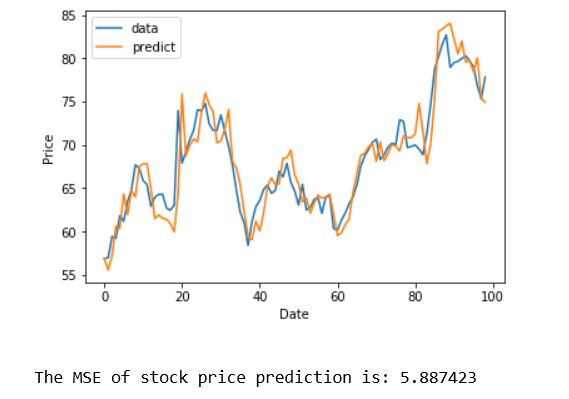

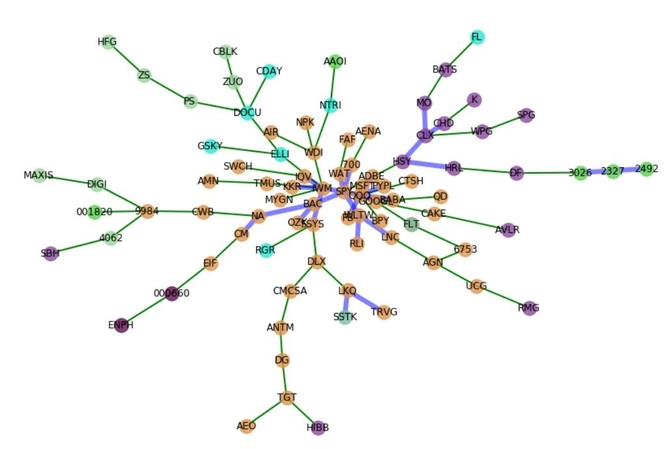

I am proficient in Python, C++, SQL and VBA. All As in Machine Learning, Statistical Data Analysis, Optimization Models & Methods, Stochastic Models, Monte Carlo Simulation, Computational Methodology in Finance, Analysis of Algorithms

Creative Innovator

At UBS, I completed changed the work and life of my team by implementing various VBA tools to handle life cycle management automatically, to mitigate the manual error calculated by trading desks, and to monitor the Greek variables dynamically. Those mini-projects saved over 20 labor hours per week.